2023 Vista CALL TO ACTION

The Grateful Dead released “Truckin'” back in 1970. I doubt the band had much to say about the stock market or even the economy back then, but their lyrics could easily summarize the last couple of years in both:

Sometimes the light's all shinin' on me

Other times, I can barely see

Lately, it occurs to me

What a long, strange trip it's been

Heck, maybe they were channeling the voice of Central Bankers around the world, just 50 years early. The light was shining on everyone as 2021 closed out…now it’s tough to see the optimism that generally reigned at the end of 2021. If you take a simplified, high-level look back at the recent past, there are very clear themes shinin’ through:

2009 – 2021:

- Low interest rates

- Low inflation

- Quantitative easing and ample liquidity

- Risk ON

That meant owning risk assets was the way to go and, really, the primary option available as lower risk investments did not offer much.

Since Q1 of 2022:

- High (er) interest rates

- High (er) inflation

- Quantitative tightening (Central banks are removing liquidity) and less liquidity

- Risk Ambivalence or even Risk Off

That all may seem like investors can “barely see” opportunity when one looks at the landscape today. Yet, our team at Vista sees it differently. For the first time in a long time, investors have real options. Our most important take away is this: what worked from “09-21, likely won’t work as well going forward.

If you or your advisor is not using this time to recalibrate and reassess your investments (private and public), an opportunity is being missed. If you work with an advisor you like, ask him or her about this different global dynamic and what they have done or will do differently. If there were no material changes and none are planned, then I believe you should ask yourself: “If changes are not warranted now, when would they be?”

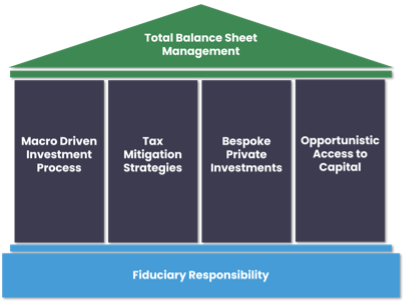

Frankly, we believe many parts of our industry have been lulled to sleep. That’s why we started Vista. Clients deserve a more dynamic approach and for us, that means a comprehensive total balance sheet approach incorporating tax management, dynamic public and private investments and access to opportunistic capital – all built on a fiduciary relationship in which we act in your best interests.

We would genuinely appreciate an opportunity to know more about you and provide more of our perspective. This includes ideas about how to address your situation with a solution that’s right for this time and this place in the context of your life and your goals. If that sounds like something that may be of interest, give me or my colleagues a call, email, submit an inquiry on our website or send us a simple text. We can’t wait to help, and we know the discussion alone is beneficial for you and for us.

Chris Williams, President & Co-Founder