May Market Update

Markets, inflation, interest rates, and the Russian invasion of Ukraine have dominated headlines the past few months. And while many investors have wondered whether the litany of bad news is already priced in markets and if the worst is behind us, we continue to reiterate our concerns that there is likely more pain to come. As expected in a Quad 4 cycle, we are in the midst of challenging times both in financial markets and in the broader economy.

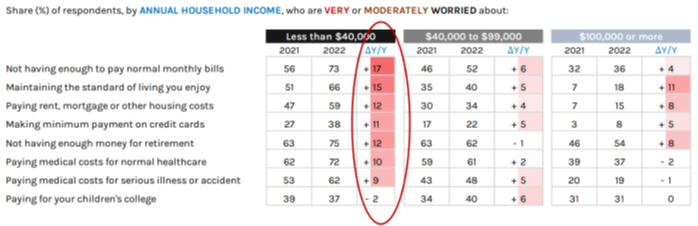

Many cite the strong labor market and historically low unemployment as signs that US consumers are in relatively good shape. However, when you look further under the hood, so to speak, the data tells a different story. In particular, lower-income families are struggling to pay for essential household expenses. Faced with higher prices at the pump, in grocery stores, and for shelter, many consumers have resorted to incurring additional credit card debt. Growth in month-over-month spending on consumer credit cards hit an all-time high in March of 2022. At the same time, the University of Michigan Consumer Confidence report fell in the first quarter to levels not seen since the Global Financial Crisis.

The impact of persistent inflation and a slowing economy has also been borne out in recent quarterly earnings reports. A lot of attention has been focused on the selloff in the technology and growth markets, but the volatility has broadened out. Target and Walmart, both considered by many to be quite defensive in nature, drastically missed earnings expectations and sold off dramatically this past week. At this point in the drawdown, every sector is down YTD except Energy.

With stubborn inflation and increasing pressure from frustrated consumers, the Fed leaders appear committed to tightening policy through shrinking their balance sheet and a steady dose of higher interest rates. Looking to the past, every previous period where we have had our Central Bank tightening policy during an economic slowdown, we have seen sharp selloffs in the markets, similar to the current environment. The catalyst for a shift in sentiment will likely mostly come down to Fed policy. Thus, we expect volatility and downward pressure in markets to continue until the Fed pivots towards more accommodative policy and ultimately lower interest rates. Time will tell how long it takes to rein in inflation.

Vista portfolios are being managed accordingly. Over the past few months, we have continued to reduce exposure to growth/risk assets and overall equity. We raised cash and added ultrashort-term bonds, added short positions against a few of the largest US indices, bought a bullish US Dollar ETF, increased our Gold exposure, and limited our sector exposure to Utilities. Expect to see more trades to de-risk portfolios in the coming weeks. When the time comes to buy the dip, we will be well-positioned with plenty of dry powder on hand to invest.

Lincoln Sorensen, Family Wealth Advisor & Co-Founder

Two-Thirds of Lower-Income Americans Have Doubts About Just Paying Their Monthly Bills